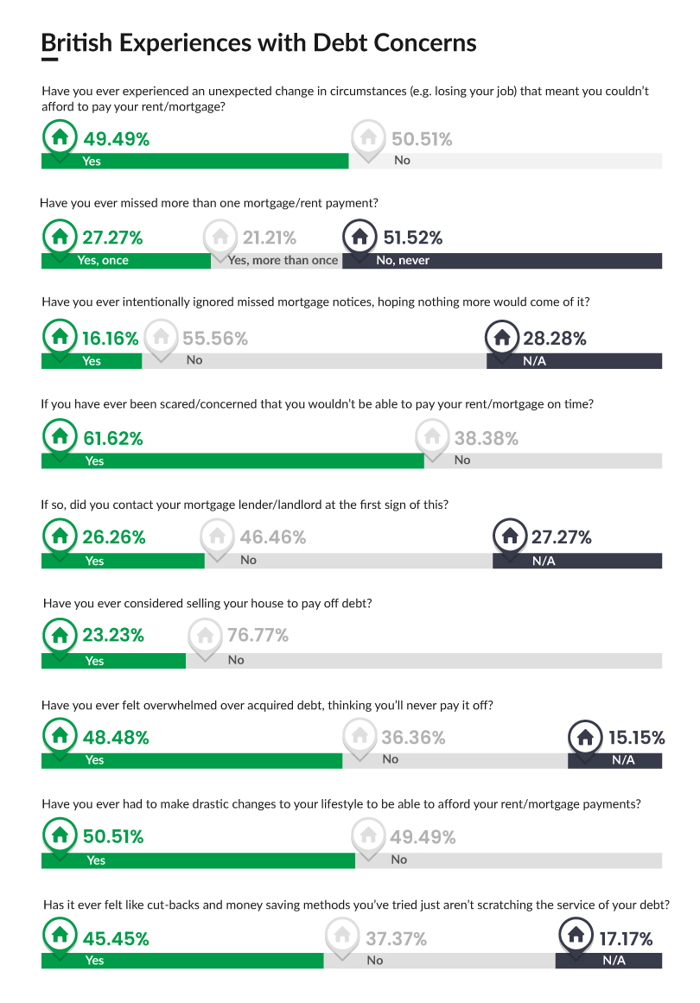

Have you ever worried that you won’t make this month’s rent? It happens more than you think. In fact, 49% of the people we surveyed at fasthomes.org said they had experienced an unforeseen change in circumstances which risked the repossession of their homes. Take a look at our results below.

Truth be told, most of us will run into issues at some point in our lives that risk our status as homeowners. Solving these problems is often a complex and difficult task, leaving many of us to wonder if it’s possible at all. So, we have created a guide on how to stop the repossession of your home, now and in the future.

Among the top causes for repossession is missed payments. 61% of the people we surveyed admitted that they have been scared they wouldn’t be able to pay their rent on time.

However, there are other causes for house eviction, including:

If money is the main cause for concern, it may be worth taking a look at your current lifestyle. Cutting back on spending can enable you to redistribute your money, helping to prevent house eviction. Just under half of the people we asked have had to do just that to help alleviate the strain on their purse strings.

(Copyright NB_Factory/shutterstock.com)

There’s probably no better time to assess your spending habits than after receiving a repossession notice through your door. It will probably help to identify what isn’t essential to your weekly shop, and cut it out.

Consider your housing bills, too. If you own your home it might help to shop around to find a cheaper deal on your utility bills, as well as those services like Spotify Premium and Amazon Prime that you don’t really need. While these cut-backs don’t seem like much, small savings add up over time and will contribute to stopping your house from being repossessed.

Do you or someone you live with work part-time? Instead of worrying about money, see if you can work more hours. Or if you’ve seen another job that you would love, you don’t need to sacrifice what you’re doing now to pursue it. Work both, even if it’s only briefly until you pay off your debt.

This part is key for those who have no other alternative. Your money problems are bad, and you’ve been threatened at least once with a repossession claim. Don’t worry, you’re not alone. 27% of the people we surveyed have missed a payment, and 21% have missed it more than once. In this situation, perhaps it’s worthwhile to move to a more affordable house.

One thing is important, though. However you sell your house, don’t just hand the keys back to your mortgage lender/landlord. They will often sell their properties via auctions which yield a lower price. If the price doesn’t cover how much you owe in debts, you’ll have to find the extra money to cover the ‘shortfall’.

You’re also still responsible for mortgage payments, buildings insurance and other costs until the lender sells the house, which could be a while. Fasthomes.org recommends that if you’re planning on selling your house to cover debt, first get a valuation to see if your house’s sale will cover it, and make sure you have organised your new accommodation before finalising.

In life, it might seem easier to ignore a problem in the hopes that it will just go away. 16% of our respondents said that they have intentionally ignored missed mortgage notices hoping that nothing more would come of it.

This is a mistake many make. At the first sign of a problem, you should talk to your lender/landlord. You may be able to negotiate another time to pay your rent. Or if you have already received a house eviction warning, you may be able to persuade them not to start proceedings just yet if you can prove that the payment will be covered. If you can’t come to an agreement, you should speak to an experienced debt advisor like Shelter or the Citizens Advice Bureau (CAB) who can help you with what to do next.

It is no secret that the UK is facing a housing crisis. The supply for housing in many areas is disproportionate to the demand and price increases have made houses unattainable. Because of this, some people unlawfully sublet their houses to others: they charge the subtenants more and pocket the extra cash. Unfortunately, there’s a possibility that you could be one of these subtenants.

If you're living in an unlawfully sublet house, whether you know of it or not, you risk being evicted. It’s important to look out for indicators such as seeing the house being advertised as a ‘short let’ opportunity on somewhere like Gumtree, and to report it to the appropriate authorities to avoid the house being repossessed.

If you’re scared that you won’t be able to pay your rent or mortgage, it’s worth investigating if you are entitled to any benefits.

The 'Support for Mortgage Interest' (SMI) is an interest loan repayment scheme that helps those already receiving income-related benefits. Also known as ‘help with housing costs’, it aims to help those on a low income to cover high living costs. It’s worth investigating if you are already receiving benefits such as:

Universal Credit

Pension Credit

Income-based Jobseeker's Allowance

Income-related Employment and Support Allowance

Income Support

However, proceed with caution. This is an interest acquiring loan that still needs to be re-payed, so if you think you won’t be able to cover it, it’s best to stay away. You could end up in a worse situation than you started in, with a larger debt to repay.

It might seem counterproductive to advise people with money problems to borrow money. Perhaps if it’s just to help you until next pay-day, borrowing money can be beneficial. However, the myriad of horror stories on the troubles of borrowing money from dodgy loan sharks should be enough to persuade most people against the idea. Only consider loans if you know you can pay them back immediately, you could lose your home if you don’t.

Another option is adding the debt you owe to the house’s mortgage capital. This is a short-term fix for homeowners and corrects the current unpaid debt. Similarly to borrowing money, if you know that you’ll be back on track soon then this is effective to take the weight off your shoulders. However, this means you’ll owe more at the end of your mortgage contract. You therefore need to be certain that the amount you have to pay every month and the length of time you’ll be paying is attainable, as you could just end up back where you were last time.

(Copyright tynyuk/shutterstock.com)

In order to get on top of paying your mortgage/rent and avoid running into any problems, here are a few final quick tips:

Feature Image (Copyright Dooder/shutterstock.com)